There’s Nothing Quite Like a Government Refund Check.

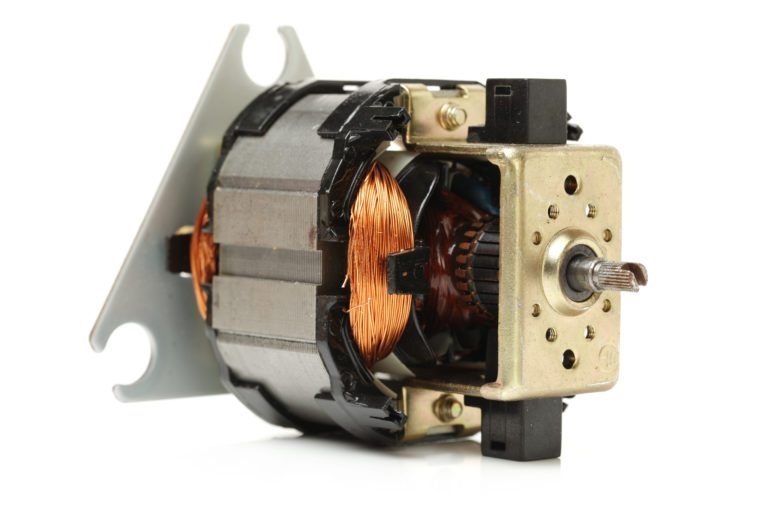

Proper classification at the time of importation is critical. The…

Proper classification at the time of importation is critical. The tariff has tens of thousands of numbers and some items are specifically provided for while others are left more vague. Getting it right requires an understanding of the General Rules of Interpretation (GRI’s), Section Notes, Chapter Notes and in some…

READ MORE